How to calculate percentage: Simple steps and real-world examples

Learn how to calculate percentage with quick, practical formulas for increases, decreases, and real-world examples you can use today.

Extensii Recomandate

Before you can really get a handle on calculating percentages, it helps to start with what the word itself means: "per one hundred." At its core, the basic formula is Percentage = (Part / Whole) × 100. This simple equation takes any fraction and turns it into a standardized figure that's easy to grasp and compare. It’s a universal language for everything from store discounts to financial reports.

Understanding What Percentages Really Mean

Let's strip away the math for a second and focus on the concept. A percentage is just a specific kind of fraction where the bottom number (the denominator) is always 100. So, when someone says "50 percent," they're just saying "50 out of 100." This framework is incredibly useful because it puts different numbers on a common playing field.

This idea isn't some newfangled math trick; it's ancient. We're talking Roman Empire ancient. Around 27 BC, Emperor Augustus levied a tax of 1/100th on goods sold at auction, known as the centesima rerum venalium. They were working with fractions based on 100 long before our modern decimal system came about. Fast forward to the late 15th century, and you’ll find arithmetic books packed with examples of calculating profit and loss using this method. You can dig deeper into the history of percentages on Wikipedia if you're curious.

Connecting Math to Your Daily Life

Today, this age-old tool is woven into the fabric of our daily lives. Take your monthly budget, for instance. Let's say your income is $4,000 a month, and you find you're spending $160 on coffee. To see how that habit fits into your overall financial picture, you’d calculate the percentage.

Using that foundational formula:

- Part: Your coffee spending ($160)

- Whole: Your total monthly income ($4,000)

The math looks like this: ($160 / $4,000) × 100, which comes out to 4%. All of a sudden, that $160 isn't just a random number—it's a tangible slice of your financial pie. Seeing it this way is far more insightful than just looking at the dollar amount on its own.

Getting good at calculating percentages isn't about memorizing formulas. It's about learning to see the relationship between numbers differently. It turns abstract data into something you can actually use.

This same logic pops up everywhere:

- Figuring out a 15% tip at dinner.

- Checking if that 30% discount on a new coat is actually a good deal.

- Seeing a 5% gain in your retirement account.

Before we dive into the nitty-gritty of different percentage calculations, let's lay out the core formulas you'll be using.

Core Percentage Formulas at a Glance

This table is your quick cheat sheet. We'll break down each of these in detail, but this gives you a high-level view of the fundamental tools you'll need.

| Calculation Type | Formula | Example Scenario |

|---|---|---|

| Finding Percentage of a Number | Percentage / 100 * Whole |

Calculating a 20% discount on a $50 item. |

| Finding the Original Whole | Part / (Percentage / 100) |

Finding the original price if a 30% discount saved you $15. |

| Finding the Percentage | (Part / Whole) * 100 |

Determining what percentage of a $2,000 budget is spent on rent of $800. |

Having these formulas handy simplifies things, but the real key is knowing when and how to apply them. That's what we'll cover next.

Cracking the Three Most Common Percentage Problems

When you get right down to it, most of the percentage questions you'll face fall into one of three common buckets. If you can get a handle on these, you'll be set for almost any situation that comes your way, whether you're figuring out a tip at a restaurant or tracking how close you are to a project deadline.

These core skills pop up everywhere. For instance, in fitness, you might want to figure out how to calculate treadmill calories burned as a percentage of your daily intake goal. Let's break down each scenario with a clear formula and a practical example.

Type 1: Finding a Percentage of a Given Number

This is the one you'll see most often. It’s all about answering questions like, "What is X% of Y?" Think about calculating a discount on a new gadget, adding a tip to a dinner bill, or figuring out sales tax. You're trying to find the specific value that a percentage represents.

Here's the go-to formula: Value = (Percentage / 100) * Whole Number

Picture this: you've been eyeing a pair of headphones priced at $250, and they just went on sale for 20% off. To see how much cash you're saving, you need to calculate 20% of $250.

Plugging that into the formula, we get (20 / 100) * $250. That works out to 0.20 * $250, which gives you a $50 discount. Your new price is $200. Simple as that.

Type 2: Finding What Percentage One Number Is of Another

Sometimes, you already have two numbers and need to understand the relationship between them. This is where you answer questions like, "What percentage is X of Y?" It’s perfect for tracking your progress toward a goal or just seeing how things stack up.

The formula for this is just as straightforward: Percentage = (Part / Whole) * 100

Let's say you're leading a project with 80 tasks on the board. So far, your team has knocked out 56 of them. To get a quick snapshot of your progress, you'd divide the part (completed tasks) by the whole (total tasks).

The math looks like this: (56 / 80) * 100. This simplifies to 0.7 * 100, telling you the project is 70% complete. For a deeper dive into how this plays out in finance, check out our guide on how to calculate investment returns.

This calculation is so powerful because it turns raw numbers into something meaningful. Saying "56 tasks are done" is just data. Saying "we're 70% complete" gives everyone on the team instant, actionable insight.

Type 3: Finding the Whole Amount from a Part and Its Percentage

This last one feels a bit like working backward. It’s for answering questions like, "If X is Y% of the total, what is the total?" This is often called a "reverse percentage" problem, and it's incredibly useful for figuring out an original price before a discount or tax was added.

You'll need this formula: Whole = Part / (Percentage / 100)

Imagine you get a surprise bonus of $1,200. Your boss mentions it represents 15% of the company's annual profit-sharing pool. Want to know how big that pool is? Just use the reverse percentage formula.

You’d calculate $1,200 / (15 / 100), which is the same as $1,200 / 0.15. The answer reveals the total profit-sharing pool was $8,000.

Nailing these three methods gives you a solid foundation for tackling just about any percentage problem life throws at you.

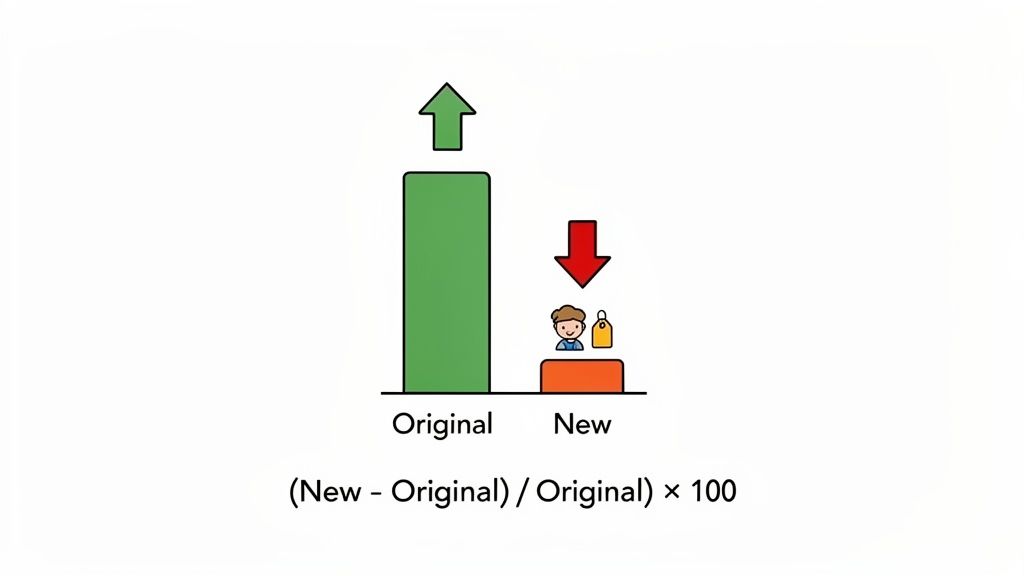

How to Calculate Percentage Increase and Decrease

Percentages really start to tell a story when they measure change. Think about it—they help us answer crucial questions every day. "How much did our sales grow this quarter?" or "What's the real discount on this clearance item?" It's all about understanding growth and decline.

The great thing is, you don't need separate methods for ups and downs. A single, powerful formula handles both, making it an essential tool for just about anything you want to measure.

Here’s the formula that does all the heavy lifting: ((New Value - Original Value) / Original Value) × 100

If your result is a positive number, you've got a percentage increase. If it's negative, it's a decrease. Simple. This calculation is a staple everywhere, from economic reports to business meetings.

Calculating a Percentage Increase

Let's walk through a real-world scenario. Imagine you're growing a social media account. At the beginning of the month, you had 1,200 followers. By the end, that number jumped to 1,500.

So, how much did your audience grow? Let's apply the formula:

- Original Value: 1,200 followers

- New Value: 1,500 followers

First, find the difference between the new and old values: 1,500 - 1,200 = 300. This is your raw growth.

Next, divide that difference by your starting point: 300 / 1,200 = 0.25.

Finally, multiply by 100 to turn that decimal into a percentage. Just like that, you know your follower count grew by a solid 25%.

This same logic is used on a much larger scale, like when economists track inflation. The U.S. Consumer Price Index (CPI), for example, uses this exact calculation. To see how prices changed, they look at the index's rise from 278.802 in December 2021 to 296.797 in December 2022. Running those numbers through the formula reveals a 6.5% increase—a clear sign that everyday goods were getting more expensive. You can read more about how percentage change is calculated in changing times.

This calculation transforms abstract numbers into a compelling story. A '300 follower' gain is just data; a '25% growth rate' is a clear indicator of performance and momentum that everyone can understand.

Figuring Out a Percentage Decrease

The formula works just as smoothly when things go down. Let’s say you’ve been eyeing a laptop originally priced at $950. You check back a week later, and it's on sale for $760. What’s the actual discount you're getting?

Let's plug the numbers into our trusted formula:

- Find the difference: $760 (New Value) - $950 (Original Value) = -$190.

- Divide by the original price: -$190 / $950 = -0.20.

- Convert to a percentage: -0.20 × 100 = -20%.

That negative sign confirms it's a decrease. You’re getting a 20% discount on the laptop.

This is just as critical for businesses keeping an eye on their performance. A company might see its quarterly revenue dip from $500,000 to $450,000. By calculating (450,000 - 500,000) / 500,000, they'd see a -10% change, a clear signal that something needs attention.

Whether you're tracking sales figures, personal savings, or stock prices, this one formula gives you the clarity to make better decisions.

Mastering Reverse Percentages for Real-World Finance

Sometimes, the most practical math problems require you to work backward. This is the idea behind reverse percentages, a skill that’s far more common in everyday finance than you might think. Instead of taking a percentage of a number, you're trying to find the original number before a percentage was added or subtracted.

Let’s imagine a classic shopping trip. You’ve just bought a new jacket, and the final bill comes to $120. You know that sales tax in your area is 20%. So, what was the actual sticker price of the jacket before tax? This is a perfect real-world scenario where knowing how to handle a reverse percentage calculation saves the day.

The Logic Behind Working Backward

The trick is to reframe what the final price actually represents. That $120 isn't just the item's cost; it’s the original price plus the 20% tax.

This means the $120 you paid is really 120% of the original amount (the 100% sticker price + the 20% tax). Once you get that, the rest is straightforward. You just need to figure out what that 100% value was.

The formula is pretty simple:

Original Amount = Final Amount / (1 + Percentage as Decimal)

Let's plug in the numbers from our jacket example:

- Final Amount: $120

- Percentage as Decimal: 20% is 0.20

The calculation becomes $120 / (1 + 0.20), or simply $120 / 1.20. Punch that into a calculator, and you get $100. The jacket’s original price was $100, and the tax added another $20.

This isn't just for shopping. This method works for any situation where a value has been increased by a percentage. You could use it to figure out your salary before a bonus was added or find the base cost of a service before fees were tacked on.

From Reverse Percentages to Financial Growth

This same logic—understanding how percentage changes affect a base number—is the bedrock of long-term financial planning, especially with investing. It’s all about how small, consistent percentage gains build on themselves over time, a powerful force known as compounding.

While reverse percentages help you find a past value, tools like a compound interest calculator do the opposite: they project forward. They show you how a starting amount can multiply by applying percentage increases over and over again. To see exactly how the math works, check out our guide that breaks down the compound interest formula and its applications.

You can see this in action right in your browser with the ShiftShift Compound Interest extension. Just plug in your starting investment, how much you plan to add, and the expected annual return.

The tool visualizes how an initial investment snowballs with regular contributions. It’s a fantastic way to see the power of consistent percentage gains and turn an abstract financial goal into a clear, achievable plan.

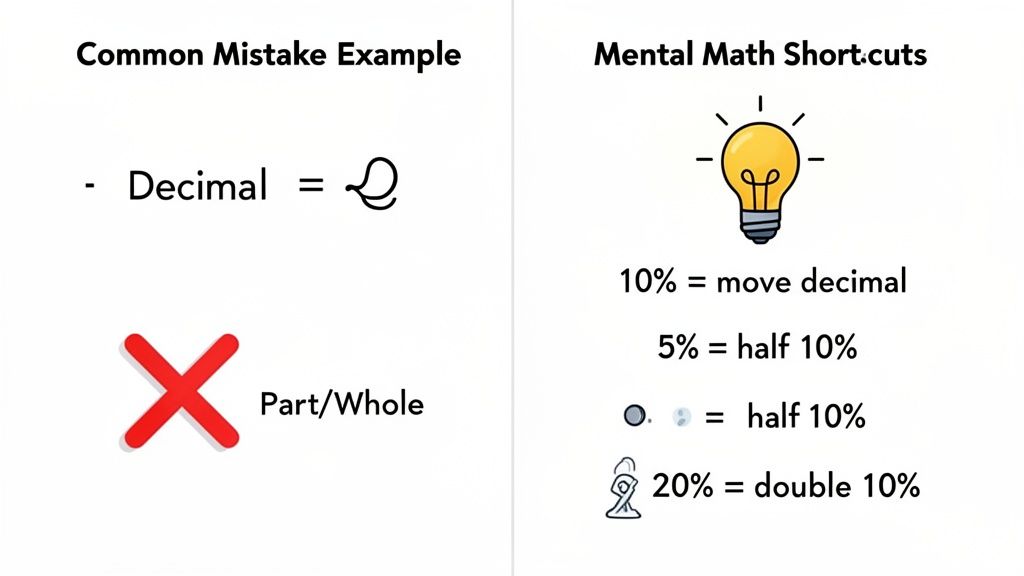

Common Mistakes and Mental Math Shortcuts

Even when you know the formulas, it’s surprisingly easy to make a small error that throws your entire calculation off. One of the most common mistakes I see is misplacing the decimal point. It's a simple slip, but it has a huge impact.

Remember, 25% converts to 0.25, not 2.5. That tiny dot one space off can inflate your result by ten times—turning a reasonable restaurant tip into a shockingly expensive meal.

Another classic blunder is mixing up the "part" and the "whole," particularly when you're figuring out a percentage increase or decrease. Your starting point, the original value, is always the denominator. If you use the new value instead, your answer will be flat-out wrong. Always take a second to confirm which number you’re dividing by.

Quick Mental Math Tricks

You don't always have to reach for a calculator. In fact, learning a few simple tricks can make you much faster at estimating percentages on the fly, whether you're eyeing a sale rack or splitting a dinner bill. If you really want to get fast, there are some great mental math shortcuts for percentages you can master.

The absolute cornerstone of mental percentage math is the 10% rule. It's brilliant in its simplicity: to find 10% of any number, you just move the decimal point one spot to the left.

- 10% of $80 becomes $8.0.

- 10% of $450 is $45.0.

- 10% of $27.50 turns into $2.75.

It's that easy. Once you've got the 10% down, you can figure out almost anything else.

Think of 10% as your building block. From there, you can construct almost any other percentage you need with simple addition, subtraction, or multiplication. It’s a powerful trick for everyday estimations.

Building On The 10 Percent Rule

Once you can instantly find 10%, the real fun begins. Need to figure out a 20% tip on a $60 bill? Just find 10% ($6) and double it. Boom, $12. What about a 5% discount? Find 10% and slice it in half.

Here’s a quick look at how you can expand on this single trick to tackle other common percentages without breaking a sweat.

Mental Math Shortcuts for Common Percentages

This little table is your cheat sheet for doing percentage math in your head. It all starts with that easy 10% trick.

| Percentage | Mental Shortcut | Example (of 400) |

|---|---|---|

| 1% | Move the decimal two places left | 4 |

| 5% | Find 10%, then halve it | 10% is 40, so 5% is 20 |

| 10% | Move the decimal one place left | 40 |

| 15% | Find 10%, find 5%, and add them | 40 + 20 = 60 |

| 20% | Find 10%, then double it | 40 x 2 = 80 |

| 25% | Divide the number by 4 | 400 / 4 = 100 |

| 50% | Divide the number by 2 | 400 / 2 = 200 |

| 75% | Find 50%, find 25%, and add them | 200 + 100 = 300 |

As you can see, a few basic shortcuts can handle most of the percentage calculations you'll run into day-to-day. These techniques are perfect for making quick, smart decisions without having to stop and pull out your phone.

Answering Your Top Percentage Questions

Even when you've got the basics down, you'll still run into specific scenarios that can leave you scratching your head. Let's tackle some of the most common questions that pop up when people start putting percentages to work.

How Do I Find a Percentage of a Total Number?

This is the bread and butter of percentage math. To figure out a percentage of any number, the first move is to turn the percentage into a decimal. You just divide it by 100. So, 20% becomes 0.20.

Once you have the decimal, multiply it by the total amount. Say you need to find 20% of $150. The math is simply 0.20 × 150, which gives you $30. The go-to formula for this is (Percentage / 100) × Total Amount.

Here’s a little trick I’ve always used: whenever you see the word "of" in a percentage problem, just think "multiply." So, "20% of 150" instantly becomes 0.20 × 150. This mental shortcut makes these problems feel much more straightforward.

What's the Quickest Way to Calculate a Percentage Increase?

When you need to find the percentage growth between two numbers, there's a single formula that gets you there fast: ((New Number - Original Number) / Original Number) × 100.

Let's say your website traffic jumped from 5,000 visitors last week to 6,000 this week. Here's how you'd plug it in:

- (6,000 - 5,000) / 5,000 = 0.20

- Then, 0.20 × 100 = 20%

That’s a 20% increase in traffic. You can even paste that whole formula into a browser search bar, and it’ll do the math for you in seconds.

How Exactly Does a Reverse Percentage Work?

Reverse percentages are a bit like detective work—you're finding the original number before a percentage was added or subtracted. A classic real-world example is figuring out a price before sales tax was added or a discount was applied.

Imagine an item costs $90 after a 10% discount. That $90 isn't the whole price; it's what's left over—it represents 90% (100% - 10%) of the original sticker price.

To find that original price, you divide the final amount by the percentage it represents (as a decimal). In this case, it's $90 / 0.90, which equals $100. So, the item originally cost $100.

Can I Do Percentage Math in a Spreadsheet?

You bet. Spreadsheets like Excel and Google Sheets are built for this stuff and are especially powerful when you're working with a lot of data. You can just type simple formulas right into the cells.

For instance, if you have a total value in cell A1 and the part you want to measure in cell B1, you'd just type =(B1/A1) into a third cell.

After you hit enter, make sure to format that cell as a "Percentage." This is hands-down one of the most efficient ways to handle a bunch of percentage calculations all at once.

Tired of wrestling with manual calculations? The in-browser tools from ShiftShift Extensions let you compute percentages, model investments, and more without ever leaving your current tab. Get started with ShiftShift Extensions and speed up your workflow today.