The 12 Best Compound Interest Calculator Tools of 2026

Discover the best compound interest calculator for any scenario. We review 12 top web, mobile, and browser tools to help you visualize investment growth.

Doporučené rozšíření

Albert Einstein famously called compound interest the "eighth wonder of the world," but visualizing its long-term power can be abstract and difficult. A high-quality calculator transforms this powerful concept from a vague financial goal into a concrete, actionable plan. It is the essential tool that bridges the gap between guessing about your retirement savings and knowing precisely what contributions are needed to reach your targets. The right tool empowers you to see how small, consistent investments can grow exponentially over time.

However, the internet is saturated with options, and not all calculators are created equal. Many are overly simplistic, some are bogged down by intrusive ads, and others lack the sophisticated features required for nuanced, real-world financial modeling, such as adjustable contribution schedules or inflation-adjusted returns. Finding the best compound interest calculator for your specific needs can be a frustrating exercise in trial and error.

This guide is designed to eliminate that guesswork. We have meticulously tested and reviewed the top 12 tools available, spanning web apps, dedicated financial websites, government resources, and even powerful in-browser extensions. Whether you are a novice investor mapping out your first savings plan, a developer modeling financial projections, or a seasoned pro comparing complex scenarios, this curated list will provide the clarity you need. For each option, you will find a direct link, a detailed breakdown of its features, and an honest assessment of its strengths and weaknesses, helping you select the perfect tool to take definitive control of your financial future.

1. Compound Interest [ShiftShift]

For investors and planners who value speed, privacy, and an integrated workflow, ShiftShift’s Compound Interest Calculator stands out as a premier in-browser solution. Rather than a standalone website, this tool is a lightweight yet powerful Chrome extension that brings sophisticated financial modeling directly into your browser, making it an exceptionally efficient choice for our best compound interest calculator. Its core strength lies in its seamless integration and real-time visualization capabilities.

![Compound Interest [ShiftShift]](https://cdn.outrank.so/9d63d2f7-ab9c-4b70-bf5c-df66cbda740c/screenshots/050192da-d8a2-4cd1-99d1-97f19281bdc6/best-compound-interest-calculator-compound-interest.jpg)

Accessible instantly via ShiftShift's Command Palette (double-press Shift or Cmd/Ctrl+Shift+P), the calculator allows you to tweak variables like principal, regular contributions, interest rate, and compounding frequency on the fly. The interactive chart immediately updates to reflect your changes, providing a clear, visual representation of your investment’s growth trajectory. This instant feedback loop is invaluable for comparing different scenarios without ever leaving your current tab.

Key Strengths & Use Cases

This calculator is engineered for modern, privacy-conscious users. All calculations are processed locally on your device, meaning no sensitive financial data is ever uploaded to a server. This design also enables full offline functionality after the initial installation. With support for over 50 currencies, it's a versatile tool for international investors or anyone modeling assets in different denominations.

Understanding the immense power of compound interest for wealth growth also means being keenly aware of its effects in reverse, such as when you need to calculate credit card interest and manage debt effectively. For those interested in the mechanics behind these projections, ShiftShift offers a detailed breakdown of the compound interest formula and its application.

| Feature | Specification |

|---|---|

| Type | Browser Extension (Chrome/Chromium) |

| Access | Free, requires browser installation |

| Key Differentiator | Local processing, in-browser access, keyboard-first UI |

| Offline Capability | Yes, fully functional offline after installation |

| Currency Support | 50+ international currencies |

| Privacy | 100% local calculations, no tracking or data uploads |

Pros:

- Interactive, real-time charts for easy growth visualization

- Supports multiple compounding frequencies and 50+ currencies

- Privacy-first architecture with offline capability

- Seamless access through a unified Command Palette for fast workflows

Cons:

- Requires a Chrome/Chromium-based browser and extension installation

- No built-in cloud sync for saving or sharing scenarios across devices

Website: https://shiftshift.app/compound-interest

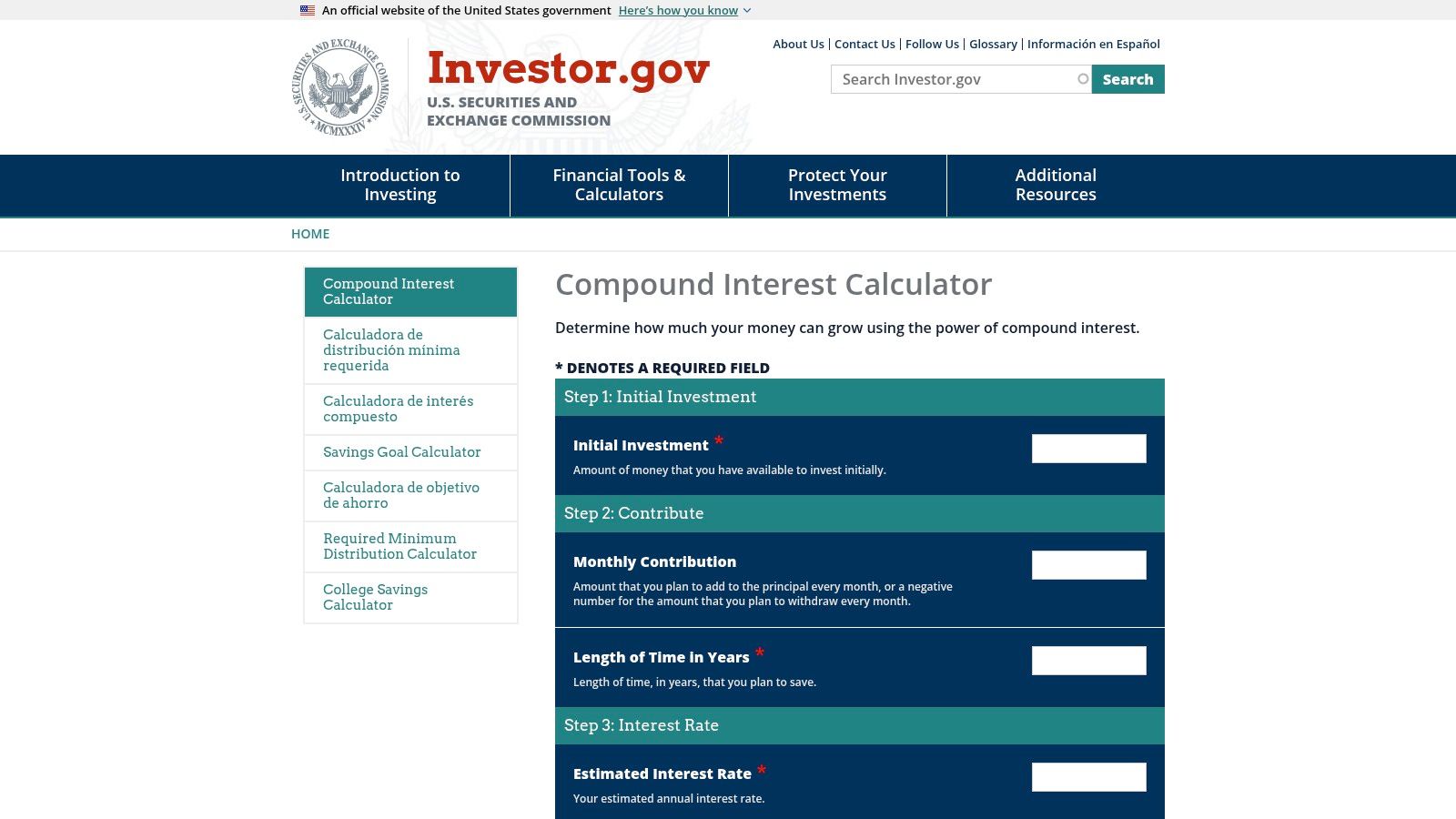

2. SEC Investor.gov – Compound Interest Calculator

For users seeking a trustworthy and straightforward tool backed by a major financial regulator, the SEC Investor.gov – Compound Interest Calculator is an excellent choice. Provided by the U.S. Securities and Exchange Commission, this free web-based calculator prioritizes education and simplicity over complex features. It offers a clean, ad-free user experience, making it a reliable resource for anyone from students to seasoned investors who need a quick, no-friction calculation without distractions. The interface is intuitive, allowing you to quickly set your initial investment, contribution amount, and time horizon.

The platform’s standout feature is the ability to add an interest rate variance. This allows you to compare two different growth scenarios side-by-side, which is perfect for visualizing how even a small difference in your annual return can significantly impact your final balance over time. The results are presented in a simple table, clearly breaking down the future value. While it lacks advanced options like tax or fee considerations, its connection to the broader Investor.gov site provides a wealth of educational materials and quizzes. For those who want a deeper understanding of the mechanics, you can explore detailed guides on how to calculate compound interest manually.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Completely free to use with no ads or tracking. |

| Inputs Supported | Initial Principal, Monthly Contribution, Years, Interest Rate | Also supports an optional interest rate variance for comparison. |

| Contribution Frequency | Daily to Annual | Flexible options to match various savings strategies. |

| Charts | No | Results are displayed in a clear, easy-to-read table. |

| Export/Print | No | Lacks functionality to save or export your calculations. |

| Privacy | High | As a government site, it does not track or store personal financial data. |

Website: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Pros:

- Highly trusted source from a U.S. government agency.

- Clean, ad-free interface ensures a focused user experience.

- Interest rate variance feature is great for scenario planning.

Cons:

- Lacks advanced inputs like taxes, inflation, or withdrawal schedules.

- No visual charts or graphs for the results.

- No option to export, print, or save the calculation data.

Best For: Educational purposes, quick and trusted estimations, and users who prioritize a simple, secure, and ad-free experience.

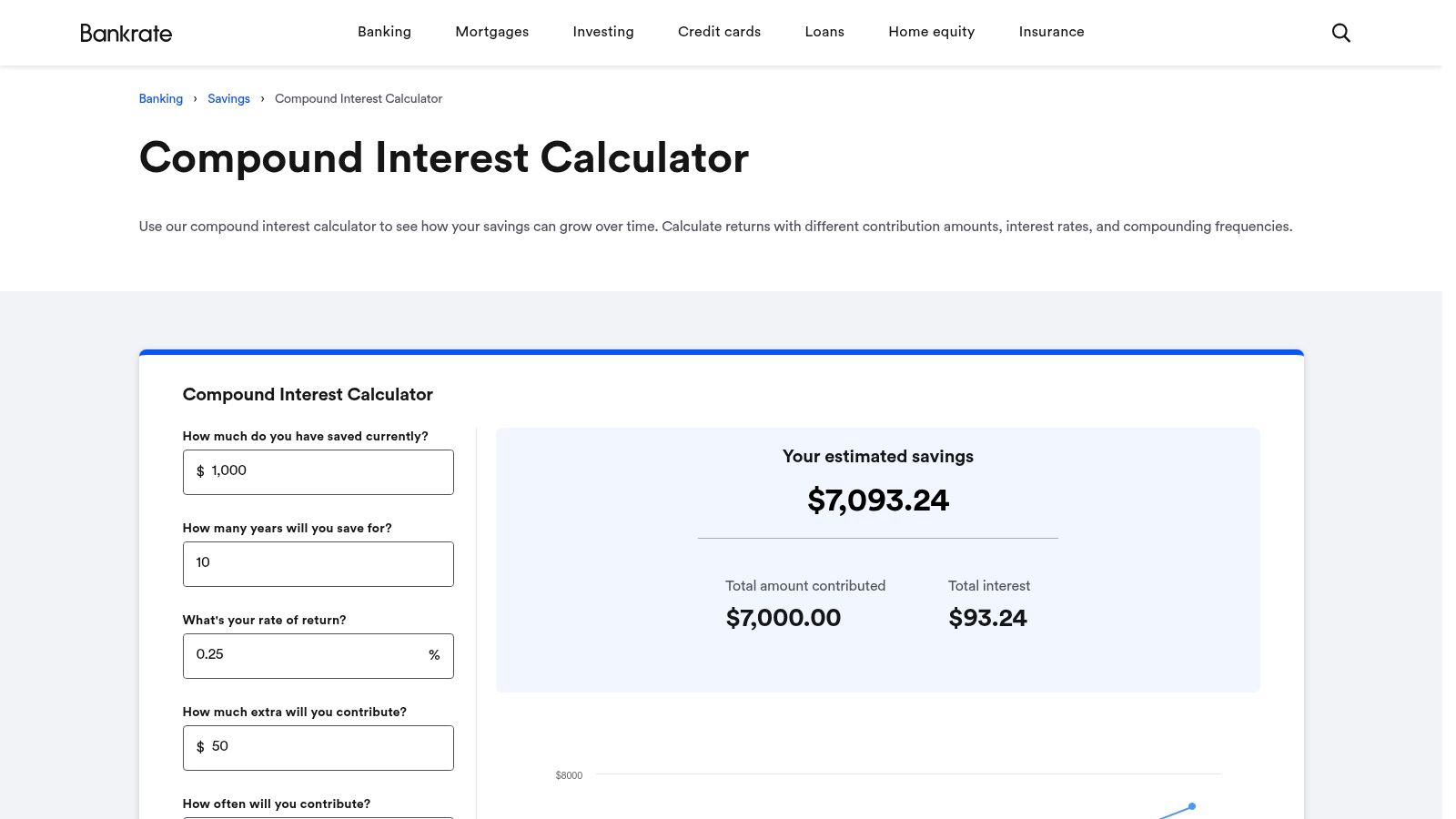

3. Bankrate – Compound Interest Calculator

For individuals who want a powerful calculation tool embedded within a broader personal finance ecosystem, the Bankrate – Compound Interest Calculator is an excellent choice. Backed by one of the most established names in consumer finance, this calculator blends robust functionality with practical, actionable advice. It offers a clean, intuitive interface that guides users through setting an initial deposit, regular contributions, and compounding frequency, making it an ideal tool for planning savings goals like retirement or a down payment. The calculator is well-suited for anyone looking to not just compute numbers but also understand their financial implications.

What sets the Bankrate calculator apart is its integration with related content and financial product recommendations. After calculating your results, the platform provides helpful articles and links to high-yield savings accounts, helping you immediately act on your financial plan. The results are displayed in a clear summary and a detailed year-by-year table, showing the principal, interest earned, and ending balance. While the presence of display ads and promotions is a minor drawback, its combination of a solid calculator with relevant financial guidance makes it a uniquely practical resource for the average consumer.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported, with promotions for financial products. |

| Inputs Supported | Initial Deposit, Contribution Amount, Time Horizon, Interest Rate | Standard set of inputs for comprehensive financial planning. |

| Contribution Frequency | Weekly to Annual | Supports weekly, bi-weekly, monthly, or annual contributions. |

| Charts | No | Results are presented in a summary and a detailed year-over-year table. |

| Export/Print | No | Lacks the ability to save or export calculation data. |

| Privacy | Moderate | As a commercial site, it uses tracking for ads and analytics. |

Website: https://www.bankrate.com/calculators/savings/compound-interest-calculator-tool.aspx

Pros:

- From a trusted, established personal finance brand.

- User-friendly interface with clear, easy-to-understand outputs.

- Paired with relevant articles and guidance to help maximize savings.

Cons:

- Contains display ads and promotional content for financial products.

- Does not offer charts or visual representations of growth.

- No functionality to export or print results for offline use.

Best For: Users looking for a reliable calculator that connects them with actionable financial advice and related savings products.

4. NerdWallet – Compound Interest Calculator

For beginners who want a calculator embedded within a comprehensive educational guide, the NerdWallet – Compound Interest Calculator is a standout option. This tool is less of a standalone application and more of an interactive element within a detailed article explaining the fundamentals of compound interest. Its primary strength lies in its simplicity and the valuable context provided right alongside the numbers, making it one of the best compound interest calculator experiences for those new to financial planning. The interface uses intuitive sliders for quick adjustments to your initial deposit, interest rate, and time frame, offering an immediate visual understanding of how these variables interact.

What sets NerdWallet apart is its educational focus. As you use the calculator, the surrounding content clarifies key concepts like the difference between APY and interest rate, helping you make more informed inputs. While the tool itself is basic and lacks advanced features like tax considerations or detailed contribution schedules, its purpose is to teach rather than to perform complex financial modeling. The results are displayed clearly, showing the total principal, interest earned, and final balance. It’s an excellent starting point for anyone looking to grasp the core power of compounding before moving on to more sophisticated tools.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported, with affiliate links present on the page. |

| Inputs Supported | Initial Deposit, Monthly Contribution, Years, Interest Rate | Basic inputs are managed with simple sliders and fields. |

| Contribution Frequency | Daily, Monthly, Annual | Offers common compounding frequencies for basic scenarios. |

| Charts | No | Results are shown in a summary table without visual graphs. |

| Export/Print | No | There are no options to save or export the calculation. |

| Privacy | Standard | As a commercial site, it uses standard tracking and cookies. |

Website: https://www.nerdwallet.com/banking/learn/what-is-compound-interest

Pros:

- Excellent for beginners due to the integrated educational content.

- Simple, user-friendly interface with sliders for quick adjustments.

- Clearly explains financial concepts alongside the calculator.

Cons:

- Lacks advanced features for in-depth financial planning.

- Website contains advertisements and affiliate promotions.

- No charts, graphs, or data export capabilities.

Best For: Students, financial novices, and anyone who wants to learn the basics of compound interest while performing simple calculations.

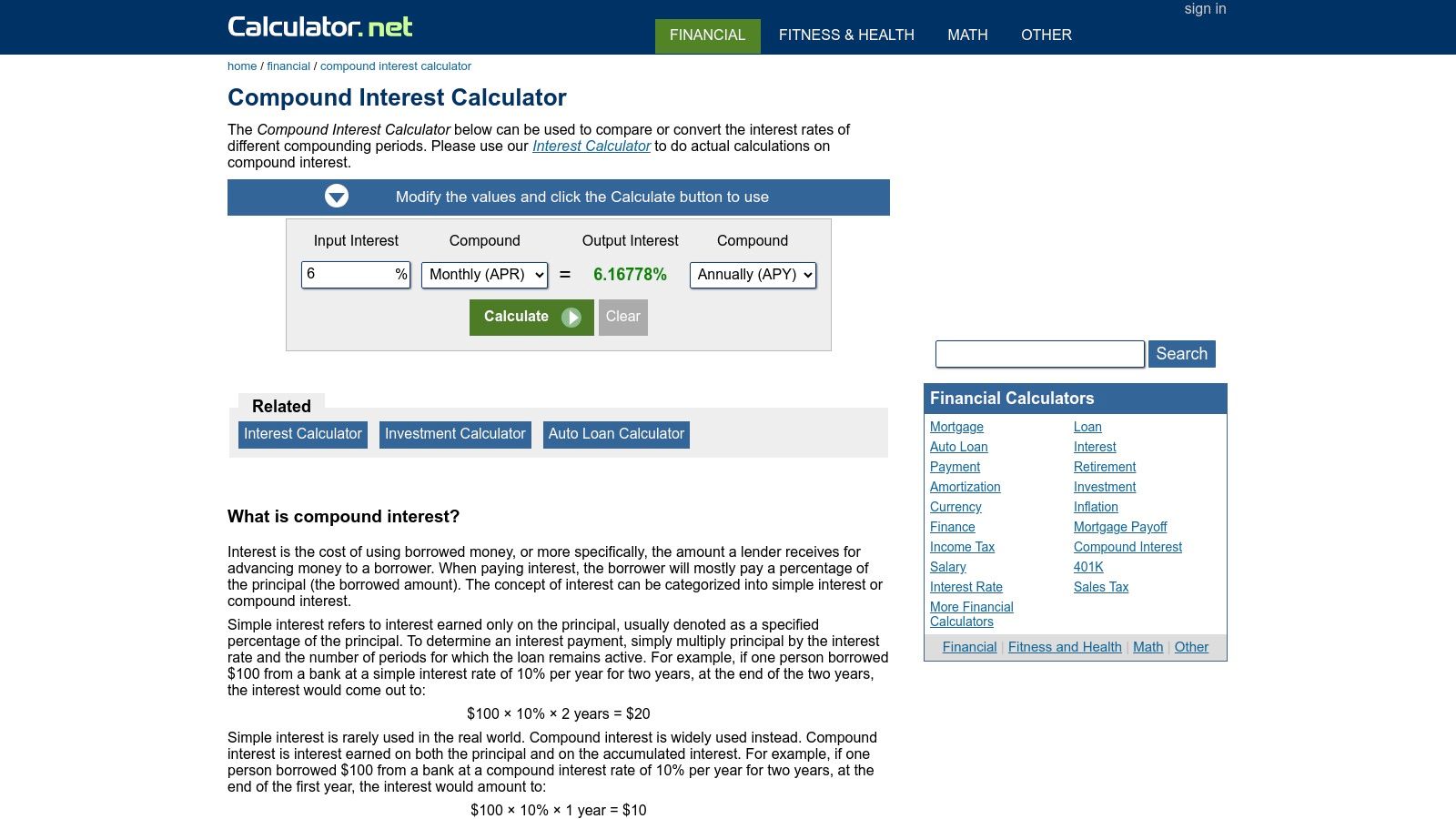

5. Calculator.net – Compound Interest Calculator

For users who value mathematical transparency and extensive customization, the Calculator.net – Compound Interest Calculator is a top-tier choice. This tool stands out by not only providing accurate calculations but also by showing the formulas used and offering a deep dive into the underlying financial principles. Its utilitarian design prioritizes function over form, making it a powerful resource for students, academics, and detail-oriented investors who want to understand the "how" and "why" behind the numbers. It is one of the best compound interest calculator options for those who want to audit the math.

The calculator's primary strength lies in its flexibility. You can set compounding frequencies from daily all the way to continuous, a feature not commonly found in simpler tools. It also allows you to solve for different variables, such as finding the required interest rate or time period needed to reach a specific financial goal. While the user interface is dated and supported by ads, the site compensates with a suite of related financial calculators and detailed explanations, making it a comprehensive hub for financial modeling and education.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported, but fully functional at no cost. |

| Inputs Supported | Principal, Contributions, Rate, Time, Compounding Frequency | Also allows you to solve for any of these variables. |

| Contribution Frequency | Daily to Annual | Includes a wide range of options for deposit schedules. |

| Charts | Yes | Provides a basic bar chart to visualize growth over time. |

| Export/Print | No | Lacks a built-in feature to export or print the results. |

| Privacy | Standard | As a typical ad-supported site, it may use tracking cookies. |

Website: https://www.calculator.net/compound-interest-calculator.html?utm_source=openai

Pros:

- Extremely flexible with a wide range of compounding frequencies, including continuous.

- Shows the exact formulas used for full transparency and educational value.

- Allows users to solve for multiple variables, not just the final balance.

Cons:

- The user interface is dated and cluttered with ads.

- Lacks advanced features like inflation or tax adjustments.

- No option to save, share, or export calculations.

Best For: Students, finance professionals, and anyone who wants to understand the mathematical formulas behind the calculations or solve for variables other than future value.

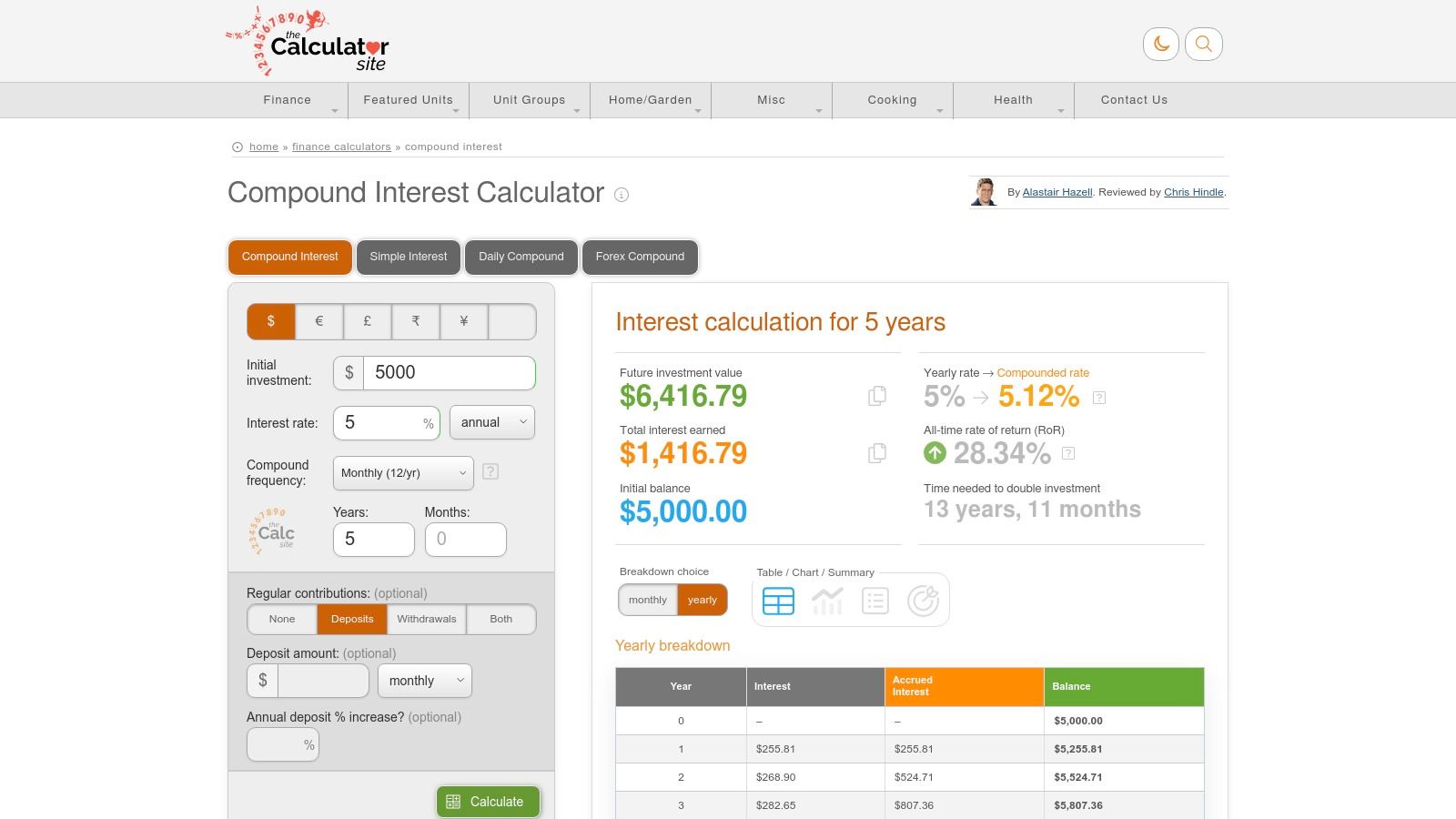

6. TheCalculatorSite – Compound Interest Calculator

For users who need to model specific, real-world compounding scenarios, TheCalculatorSite – Compound Interest Calculator offers a unique level of control. As a long-running and established tool, it provides a robust and practical set of features that go beyond basic calculations. It is particularly well-suited for individuals whose investments compound on a daily basis, such as certain types of interest-bearing accounts or high-frequency trading scenarios, by allowing for more granular adjustments than most other calculators.

The platform’s standout feature is its detailed daily compounding options. You can specify a custom number of compounding periods per year (from 1 to 365) and even choose to exclude weekends from the calculation, which is a practical option for modeling investments tied to market business days. The calculator also supports multiple currencies, displaying results with the appropriate symbol. While the interface is functional and straightforward, it does contain ads, which may be a drawback for some users. The results are presented in a clear table and accompanied by a simple line chart for visualization.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported, but no cost to use the full functionality. |

| Inputs Supported | Principal, Contributions, Rate, Years, Compounding Frequency | Also includes an option to exclude weekends for daily compounding. |

| Contribution Frequency | Daily to Annual | Offers a full range of standard contribution frequencies. |

| Charts | Yes | A simple line chart visualizes the investment growth over time. |

| Export/Print | No | Lacks a built-in feature to save or export the results. |

| Privacy | Standard | As a public website with ads, it may use standard tracking cookies. |

Pros:

- Highly granular control over compounding frequency.

- Unique option to exclude weekends for realistic daily compounding.

- Supports multiple currencies for international users.

Cons:

- User interface contains advertisements.

- Lacks advanced features for tax or inflation modeling.

- Results cannot be exported or easily saved.

Best For: Users needing to model specific daily compounding schedules, international users, and those who want a mature, time-tested calculator with practical options.

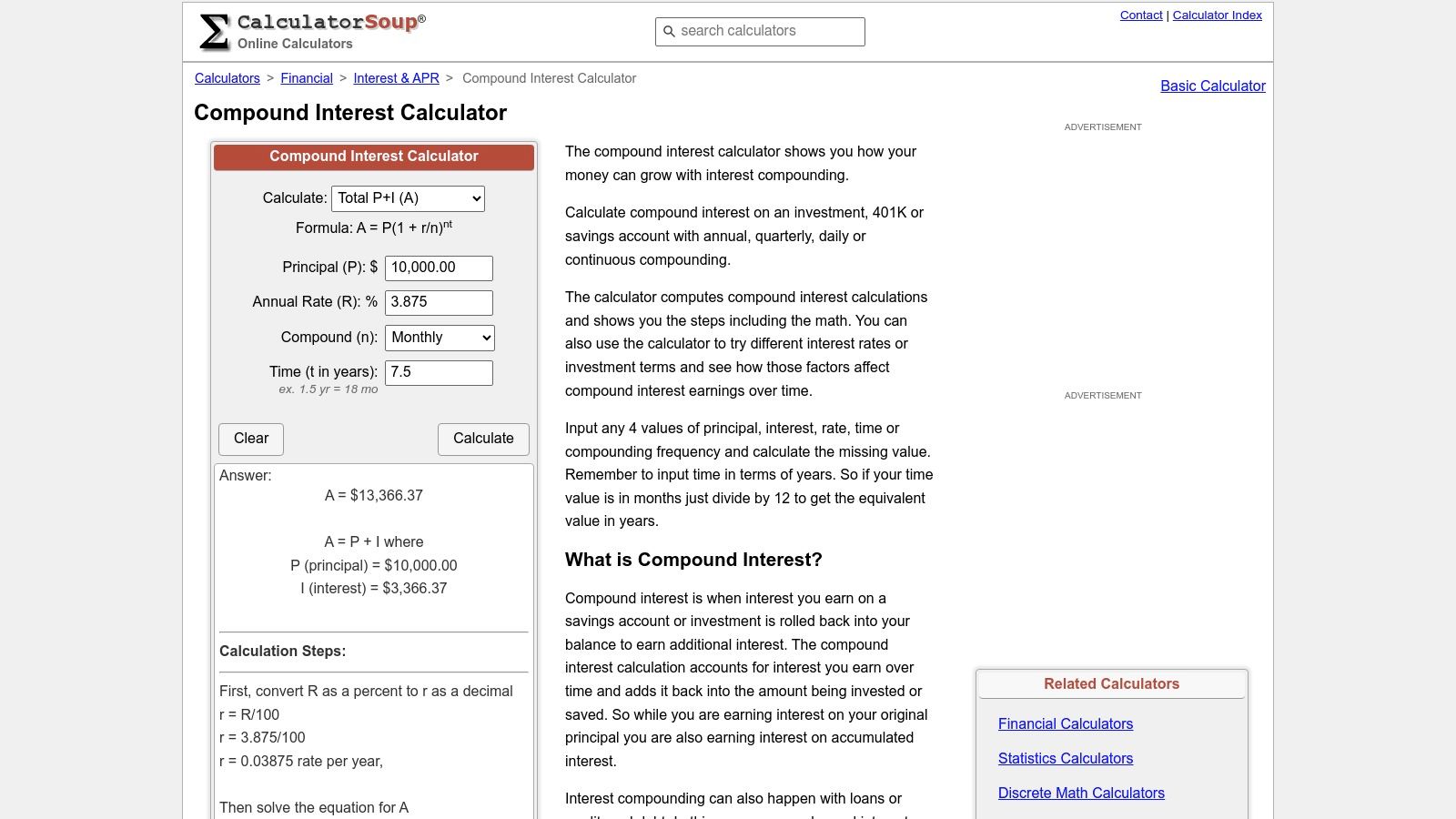

7. CalculatorSoup – Compound Interest Calculator

For users who want to understand the "how" and "why" behind their calculations, CalculatorSoup – Compound Interest Calculator is an outstanding educational resource. More than just a simple input-and-output tool, this calculator breaks down the entire mathematical process, showing the exact formulas used and the step-by-step work to arrive at the final number. This transparency makes it a powerful learning aid for students, teachers, or anyone looking to build a deeper financial literacy and verify their own manual calculations.

The platform’s most distinctive feature is its ability to solve for different variables, including the future value (A), principal (P), rate (R), or time (t). It also provides ready-to-use formulas that you can copy directly into Excel or Google Sheets, bridging the gap between a quick web calculation and a more robust personal spreadsheet. While the interface contains ads and lacks sophisticated visual charts, its focus on detailed, transparent explanations makes it one of the best compound interest calculator options for educational purposes and for those who want to integrate the formulas into their own financial models.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported, but completely free to use. |

| Inputs Supported | Principal, Rate, Time, Compounding Frequency | Also supports monthly, quarterly, or annual contributions. |

| Solve for Variable | Yes | Can solve for A, P, R, or t, showing the work for each. |

| Charts | No | Focuses on numerical tables and calculation steps. |

| Export/Print | No | Provides copyable formulas for Excel/Google Sheets instead. |

| Privacy | Standard | A public website with ads; not ideal for sensitive data. |

Website: https://www.calculatorsoup.com/calculators/financial/compound-interest-calculator.php

Pros:

- Excellent for learning, as it shows full step-by-step calculations.

- Provides copyable formulas for direct use in spreadsheets.

- Flexible enough to solve for different variables in the compound interest formula.

Cons:

- The user interface includes banner and sidebar advertisements.

- Lacks any form of visual charts or graphs.

- The design feels more functional and less modern than competitors.

Best For: Students, educators, and users who want to understand the underlying math or need ready-made formulas for Excel and Google Sheets.

8. Moneychimp – Compound Interest Calculator

For DIY investors and finance enthusiasts who appreciate a classic, no-frills approach, the Moneychimp – Compound Interest Calculator is a long-standing favorite. This lightweight, web-based tool prioritizes function over form, delivering fast and accurate calculations without any modern design distractions. It offers a simple, uncluttered interface that gets straight to the point, making it one of the best compound interest calculator options for users who need to run quick "what-if" scenarios without navigating complex menus or advertisements. Its barebones design ensures it loads instantly on any device.

A key differentiator for Moneychimp is its support for specifying whether contributions are made at the start or end of each period. This subtle but important detail allows for more precise financial modeling, particularly for those analyzing annuities or specific investment plans. While it lacks visual charts and advanced features, the site provides a year-by-year breakdown in a simple table. The platform also links to a suite of other core investment calculators, making it a handy, bookmarkable resource for a wide range of financial calculations.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Completely free to use, supported by minimal, non-intrusive ads. |

| Inputs Supported | Principal, Annual Addition, Years to Grow, Interest Rate | Includes a key option for start vs. end-of-period contributions. |

| Contribution Frequency | Annual | Contributions are modeled on a yearly basis only. |

| Charts | No | Results are shown in a year-by-year data table. |

| Export/Print | No | You can copy-paste the data table, but there is no dedicated export feature. |

| Privacy | High | No personal data is required or stored; calculations are processed in-browser. |

Website: https://www.moneychimp.com/calculator/compound_interest_calculator.htm?utm_source=openai

Pros:

- Extremely fast, lightweight, and distraction-free interface.

- The start vs. end-of-period deposit feature allows for more accurate modeling.

- Part of a larger suite of trusted, simple financial tools.

Cons:

- Dated user interface may not appeal to all users.

- Lacks visual charts, graphs, and modern export options.

- Only supports annual contributions, which is less flexible than other tools.

Best For: DIY investors, finance students, and anyone needing a rapid, no-nonsense calculator for quick scenario testing and fundamental analysis.

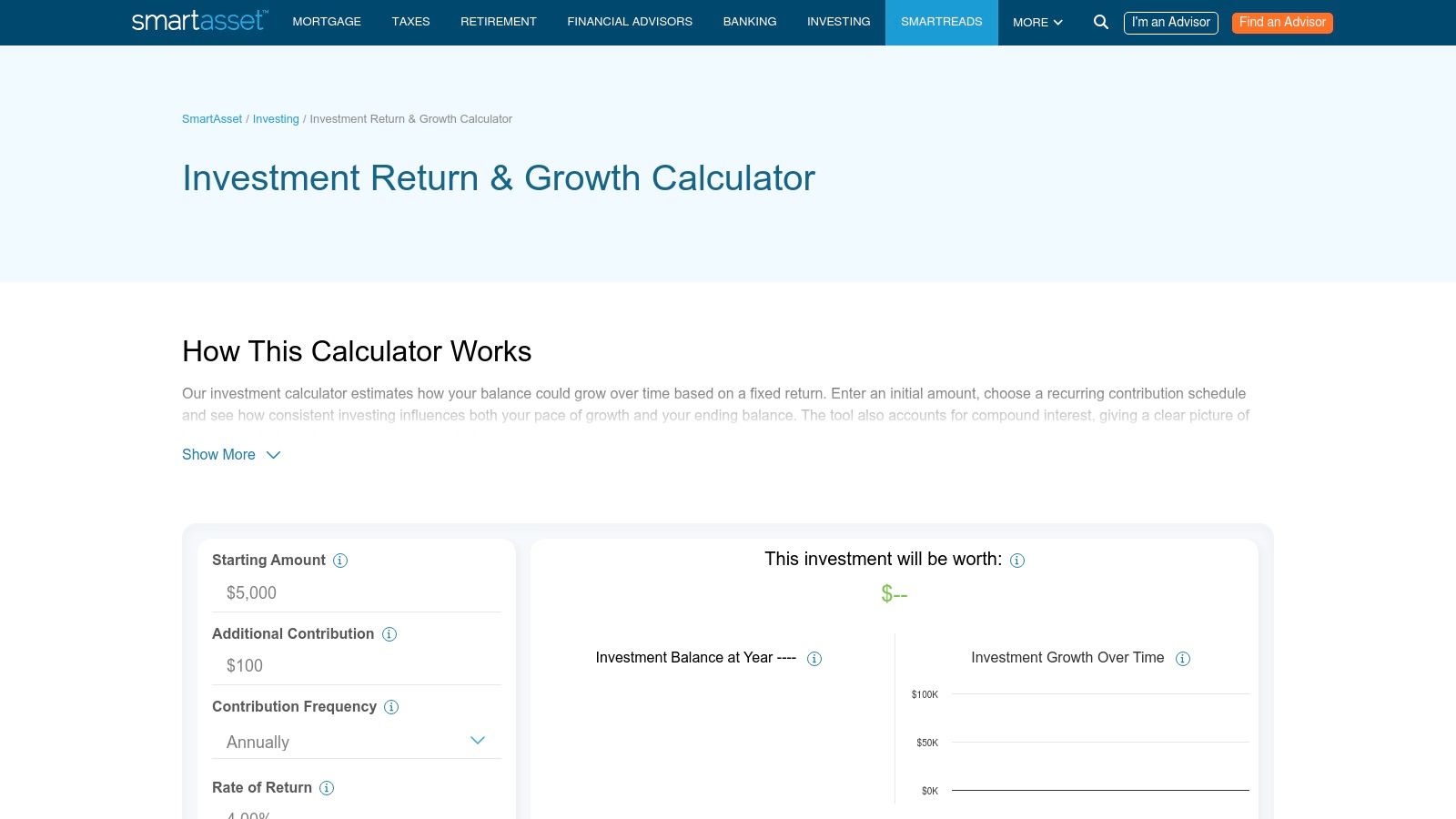

9. SmartAsset – Investment Growth Calculator

For new investors who prioritize clear visuals and an easy-to-understand breakdown of their potential earnings, the SmartAsset – Investment Growth Calculator is a strong contender. This free tool is designed to model investment growth with recurring contributions, making it an excellent starting point for those planning their savings journey. The platform guides users through setting an initial amount, ongoing contributions, time frame, and expected rate of return, presenting the results in a highly digestible format. Its clean interface focuses on making financial projections accessible rather than overwhelming.

The calculator’s main strength lies in its visual presentation. It generates a simple line graph showing the growth trajectory and provides a clear summary that separates total contributions from total interest earned. This distinction is incredibly useful for beginners who want to see exactly how much of their final balance comes from compounding. While it is a powerful educational tool, it does lack advanced inputs like taxes or fees. Users who want a more detailed understanding of performance metrics can learn how to calculate investment returns on their own. The site also includes prompts to connect with financial advisors, which may be a drawback for some.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free | Ad-supported and includes lead-generation prompts for financial advisors. |

| Inputs Supported | Initial Amount, Monthly Contribution, Years, Rate of Return | Focuses on core variables for straightforward investment projections. |

| Contribution Frequency | Monthly | Limited to monthly contributions, which may not suit all savings plans. |

| Charts | Yes | Provides a clear line chart visualizing investment balance growth over time. |

| Export/Print | No | There are no built-in options to save, export, or print the results. |

| Privacy | Moderate | As a commercial site, it may use data for marketing or lead generation. |

Website: https://smartasset.com/investing/investment-calculator

Pros:

- Excellent visual summaries and charts for easy comprehension.

- Clearly distinguishes between contributions and interest earned.

- User-friendly interface is ideal for beginners.

Cons:

- Lacks advanced inputs like taxes, inflation, or fees.

- Includes prompts to match users with financial advisors.

- Contribution frequency is fixed to monthly.

Best For: Beginner investors, users who prefer visual data representation, and anyone needing a quick, clear projection of investment growth.

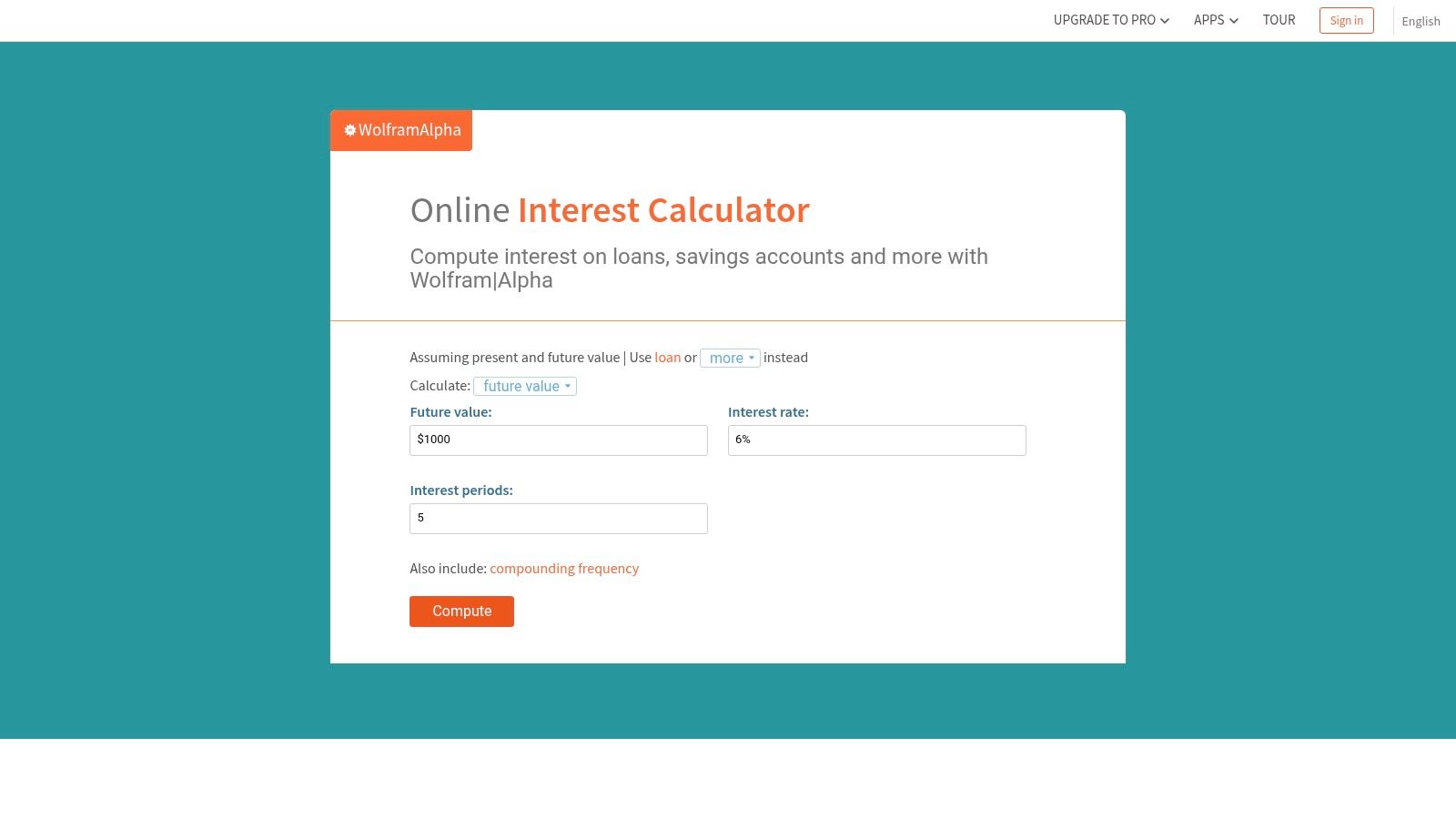

10. Wolfram|Alpha – Interest/Compound Interest Calculator

For users who need to solve complex or non-standard financial problems, Wolfram|Alpha – Interest/Compound Interest Calculator is less a simple calculator and more a powerful computational engine. Instead of filling out form fields, users can input natural-language queries like "compound interest on $5000 at 6% over 10 years with $100 monthly deposits" to get a detailed breakdown. It excels at handling unique scenarios, including continuous compounding, custom time periods, or even solving for an unknown variable like the interest rate.

What truly sets Wolfram|Alpha apart is the depth of its output. The platform automatically generates exact symbolic expressions, plots, and data tables showing the investment's growth over time. This makes it an invaluable tool for students, academics, and finance professionals who require mathematical precision and detailed visualizations. While the interface is less guided than typical calculators and the free tier has some limitations, its ability to interpret and compute almost any financial query makes it one of the most versatile and powerful tools available for interest calculations.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Freemium | Basic calculations are free; Pro version unlocks more computational power and step-by-step solutions. |

| Inputs Supported | Natural Language Query | Supports nearly any variable: principal, rate, time, contributions, and even continuous compounding. |

| Contribution Frequency | Any | Can specify daily, weekly, monthly, or any other custom frequency in the query. |

| Charts | Yes | Automatically generates plots showing investment growth and balance over time. |

| Export/Print | Yes (Pro) | Pro users can download results as a PDF or other formats. |

| Privacy | Moderate | Queries may be stored and used to improve the service; avoid entering sensitive personal data. |

Website: https://www.wolframalpha.com/calculators/interest-calculator?utm_source=openai

Pros:

- Extremely powerful for non-standard and complex calculations.

- Natural-language input makes it flexible and versatile.

- Automatically produces detailed plots, tables, and mathematical expressions.

Cons:

- The interface can be intimidating for users seeking a simple, guided experience.

- Full functionality and step-by-step solutions require a paid Pro subscription.

- Less intuitive for straightforward "what-if" scenario planning.

Best For: Academics, math students, and power users who need to solve complex, non-standard interest problems with mathematical precision.

11. Dinkytown.net Financial Calculators – Compound Interest

For financial institutions or businesses seeking a professional, licensable solution, Dinkytown.net Financial Calculators – Compound Interest is a unique entry. While publicly accessible for individual use, its primary model is providing white-label, embeddable calculators to banks, credit unions, and financial advisory firms. This means the tool is built to a professional standard, often featuring ADA compliance and updates reflecting current financial regulations. The interface is business-like, focusing on clear data input and comprehensive reporting rather than flashy visuals.

The platform’s standout quality is its institutional-grade reliability and feature set. Unlike many free tools, Dinkytown.net often includes detailed reports, amortization schedules, and printable summaries, though the exact features can vary depending on which institution's version you access. For an individual, it serves as a powerful and robust compound interest calculator, but its true value shines for organizations that need to seamlessly integrate a proven financial tool into their own websites. It provides a level of trust and customization that consumer-focused apps typically lack.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free (Public Demo), Paid (Licensing) | Free for public use; organizations pay a fee for white-label versions. |

| Inputs Supported | Varies, but typically includes Principal, Contributions, Rate, Time | Often includes more advanced options like tax considerations in licensed versions. |

| Contribution Frequency | Monthly to Annual | Standard frequencies are supported to model different saving habits. |

| Charts | Yes | Includes graphs and detailed report views for clear data visualization. |

| Export/Print | Yes | Often includes options to print or view a detailed report. |

| Privacy | High | As a business-to-business provider, privacy and data security are prioritized. |

Website: https://www.dinkytown.net/?utm_source=openai

Pros:

- Professional, institution-grade calculator trusted by banks.

- Offers embeddable and licensable versions for business websites.

- Includes detailed reports and visual graphs.

Cons:

- Public-facing demos can have inconsistent interfaces.

- Licensing involves costs for businesses wanting a branded version.

- Can feel more complex than simple, consumer-focused tools.

Best For: Financial institutions, businesses, and bloggers who need to embed a reliable and professional calculator on their own websites.

12. Apple App Store – “Compound Interest Calc” (iPhone/iPad app)

For Apple users who prefer a dedicated mobile application, the “Compound Interest Calc” app for iPhone and iPad is a powerful and highly-rated tool. This app excels by offering both growth and retirement-withdrawal planning modes, making it a versatile financial companion for various life stages. It moves beyond basic calculations by incorporating inflation adjustments, providing a more realistic projection of your future purchasing power. The clean, native iOS interface ensures a smooth and intuitive user experience for quick scenario testing on the go.

One of the app's standout features is its detailed year-by-year table, which breaks down your balance, contributions, and interest earned over the entire investment period. This is complemented by interactive charts that help visualize your growth trajectory, making complex data easy to understand. As a native app, it works entirely offline, ensuring your financial data remains on your device. While the app is free with ads, a small one-time in-app purchase provides an ad-free experience, making this one of the best compound interest calculator options for dedicated iOS users.

Key Features and Assessment

| Feature | Availability | Notes |

|---|---|---|

| Price | Free (with Ads) | A small, one-time in-app purchase is available to remove ads. |

| Inputs Supported | Initial Principal, Contributions, Rate, Years, Inflation | Includes both accumulation and withdrawal (retirement) modes. |

| Contribution Frequency | Monthly to Annual | Standard options for typical savings and investment schedules. |

| Charts | Yes | Interactive charts visualize growth over time. |

| Export/Print | No | Lacks functionality to export the data or tables. |

| Privacy | High | All calculations are performed on-device and data is not shared. |

Website: https://apps.apple.com/us/app/compound-interest-calc/id1509212588?utm_source=openai

Pros:

- Works offline, ensuring privacy and accessibility anywhere.

- Includes both growth and retirement-withdrawal planning modes.

- Features inflation adjustments for more realistic forecasting.

Cons:

- Exclusive to iOS and iPadOS devices; not available on Android or web.

- Free version contains advertisements.

- No option to save or export calculation results.

Best For: iPhone and iPad users who want a dedicated, feature-rich mobile app for quick financial planning and scenario testing, even without an internet connection.

Top 12 Compound Interest Calculators — Comparison

| Tool | Core features | UX (★) | Price (💰) | Audience (👥) | Unique / Standout (✨/🏆) |

|---|---|---|---|---|---|

| Compound Interest [ShiftShift] | Interactive charts, multiple frequencies, 50+ currencies, local/offline | ★★★★★ | 💰 Free, privacy-first | 👥 Investors & power users | ✨ Local processing & Command Palette access; 🏆 keyboard-first, multilingual |

| SEC Investor.gov – Compound Interest | Configurable contributions, rate-variance scenarios, education links | ★★★★☆ | 💰 Free (trusted .gov) | 👥 Retail investors & learners | 🏆 Official, educational resources |

| Bankrate – Compound Interest | Contribution controls, compounding options, guidance articles | ★★★★ | 💰 Free (ads/promos) | 👥 Consumers seeking practical advice | ✨ Paired guidance & savings strategy tips |

| NerdWallet – Compound Interest | Sliders for deposits/rate/time, explainer content | ★★★★ | 💰 Free (affiliate content) | 👥 Beginners & learners | ✨ Beginner-friendly tips and contextual guidance |

| Calculator.net – Compound Interest | Many compounding modes, solve-for options, formula walkthroughs | ★★★★ | 💰 Free (ads) | 👥 Advanced DIY users & auditors | ✨ Transparent math steps and flexibility |

| TheCalculatorSite – Compound Interest | Custom compounding counts, exclude weekends, multi-currency | ★★★★ | 💰 Free (ads) | 👥 Users needing fine-grained daily models | ✨ Exclude-weekend option; high granularity |

| CalculatorSoup – Compound Interest | Solve for A/P/R/t, worked steps, copyable spreadsheet formulas | ★★★★ | 💰 Free (ads) | 👥 Learners & spreadsheet users | ✨ Ready-to-paste Excel/Sheets formulas |

| Moneychimp – Compound Interest | Start/end-period deposits, simple interface, related tools | ★★★★ | 💰 Free | 👥 DIY investors who want speed | ✨ Fast, distraction-free what‑if testing |

| SmartAsset – Investment Growth | Recurring contributions modeling, clear charts, interest summary | ★★★★ | 💰 Free (lead-gen prompts) | 👥 New investors | ✨ Visual onboarding; clear summary of interest earned |

| Wolfram | Alpha – Interest/Compound Interest | Natural-language input, symbolic expressions, plots & tables | ★★★★★ | 💰 Free tier; paid Pro for advanced | 👥 Power users & researchers |

| Dinkytown.net – Compound Interest | ADA-compliant, graphs/reports, embeddable/licensable calculators | ★★★★ | 💰 Free demos; paid licensing 🏷️ | 👥 Banks, credit unions, institutions | 🏆 Professional embeddable/licensable calculators |

| Apple App Store – “Compound Interest Calc” | Growth & withdrawal modes, inflation adj., year-by-year tables | ★★★★★ | 💰 Free / IAP to remove ads | 👥 Mobile iOS users | ✨ Offline mobile charts; withdrawal planning mode |

Choosing Your Growth Partner: Final Recommendations

We have navigated through a diverse landscape of compound interest calculators, moving from the authoritative simplicity of government-backed tools to the advanced computational power of platforms like Wolfram|Alpha. The journey has revealed a clear truth: the best compound interest calculator is not a one-size-fits-all solution. Instead, it is the one that aligns perfectly with your specific needs, workflow, and financial curiosity.

Our exploration highlighted distinct categories of tools. For absolute beginners seeking foundational knowledge and trustworthy, straightforward projections, the SEC’s Investor.gov calculator stands out. Its ad-free interface and educational focus make it a reliable starting point for anyone new to the concept of compounding. Similarly, for those who need to see the "how" behind the results, CalculatorSoup’s detailed formula breakdowns provide invaluable academic insight.

For users who prefer dedicated web platforms with more robust features, tools from Bankrate and NerdWallet offer a blend of calculation and contextual financial content. However, these often come with the trade-offs of advertisements and the need to navigate to a specific website, which can interrupt your flow of thought or research.

Matching the Tool to Your Financial Workflow

Selecting the right calculator depends entirely on your primary use case. To make the best choice, consider your daily habits and long-term goals.

- For the Occasional Planner: If you only need to run projections a few times a year, a simple, bookmarkable web tool like TheCalculatorSite or Investor.gov is perfectly sufficient. They are reliable and get the job done without unnecessary complexity.

- For the Academic Learner: If your goal is to understand the mechanics of compound interest, CalculatorSoup or the computational engine of Wolfram|Alpha will serve you best. These tools expose the underlying formulas and allow for more complex, variable-driven queries.

- For the Mobile-First Investor: If you do most of your financial tracking on the go, a dedicated mobile app like “Compound Interest Calc” from the Apple App Store provides the convenience of offline access and a touch-friendly interface, making it ideal for quick checks anytime, anywhere.

- For the Power User and Daily Strategist: For those who frequently model different investment scenarios, test contribution strategies, or need instant answers without breaking their concentration, the requirements are more demanding. This user needs speed, privacy, and seamless integration into their existing digital environment.

Our Top Recommendation for Efficiency and Privacy

After thorough review and hands-on testing, the ShiftShift Compound Interest Calculator emerges as our top recommendation for the modern power user, developer, and everyday investor. Its fundamental advantage lies in its unique delivery as a browser extension, accessible instantly via a command palette. This completely redefines the user experience. There is no need to open a new tab, search for a bookmark, or navigate away from the article or spreadsheet you are currently analyzing.

This in-browser convenience is a game-changer for productivity. You can be reading a financial news article, see a mention of a 7% annual return, and immediately model what that looks like over 20 years without ever leaving the page. This seamless workflow encourages more frequent and spontaneous financial modeling, which is key to building strong financial intuition.

Furthermore, ShiftShift’s commitment to local processing directly addresses the growing concern over data privacy. Your financial inputs-your initial principal, contribution amounts, and interest rates-are never sent to a server. They are processed entirely within your browser, ensuring your financial planning remains completely confidential. The addition of interactive charts, multi-currency support, and a clean, focused interface makes it not just a tool, but a true growth partner integrated directly into your daily digital life. It is, for these reasons, the best compound interest calculator for those who value speed, security, and seamless integration.

Ready to transform how you visualize your financial future? The Compound Interest Calculator is just one of over 75+ powerful, privacy-focused utilities available in ShiftShift Extensions. Install the all-in-one suite today to gain instant, in-browser access to tools that streamline your workflow, from image converters for designers to diff checkers for developers.