The Compound Interest Formula Explained for Everyday Investors

Discover how money really grows. This guide to the compound interest formula explained with simple analogies, real-world stories, and step-by-step examples.

At its core, the compound interest formula is a way to see the future. It's a mathematical crystal ball showing how a sum of money can grow over time, but with a powerful twist. Instead of just earning interest on your initial investment, you start earning interest on the interest itself.

This "interest on interest" phenomenon is the secret sauce behind long-term wealth creation.

Understanding the Financial Snowball Effect

Picture a small snowball perched at the top of a long, snowy hill. Give it a gentle nudge, and it starts to roll. It moves slowly at first, picking up just a little bit of snow. But as it travels, it gathers more snow, gets bigger, and moves faster. By the time it reaches the bottom, it's a massive, unstoppable force.

That's the perfect way to think about compound interest. It’s a financial snowball, where your money starts building on itself, creating momentum that eventually leads to exponential growth.

Simple vs. Compound Growth

To really get why compounding is such a big deal, you have to see it next to its much less exciting cousin: simple interest.

- Simple Interest: This is straightforward. Interest is calculated only on the original amount you invested (the principal). Put $1,000 in an account with 5% simple interest, and you'll earn exactly $50 every single year. The growth is a straight, predictable line.

- Compound Interest: This is where the magic happens. Interest is calculated on the principal plus all the interest you've already earned. With that same $1,000, you’d earn $50 in the first year. But in the second year, you’re earning 5% on $1,050, which comes out to $52.50. It might not sound like much, but over a few decades, that tiny difference becomes a massive chasm.

The key takeaway is this: simple interest pays you a flat fee, while compound interest pays you an ever-increasing amount as your balance gets bigger.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.”

This famous line, often credited to Albert Einstein, nails the two-sided nature of compounding. It's your best friend when you're investing and your worst enemy when you're borrowing money on a high-interest credit card.

Why Compounding Is a Cornerstone of Wealth

Getting your head around this concept is the first real step toward building wealth that lasts. From your 401(k) to a stock market portfolio, every effective long-term financial strategy is built on this very principle.

It’s not some get-rich-quick trick. It’s a slow, steady, and incredibly powerful process that rewards patience and consistency above all else. Your money doesn’t just grow—it learns to grow faster on its own.

To truly appreciate this financial snowball, it helps to dive a little deeper into the magic of compound interest. This foundational knowledge pulls back the curtain on what seems complex, showing it's a simple idea anyone can use to their advantage.

Decoding the Compound Interest Formula

At first glance, the compound interest formula, A = P(1 + r/n)^(nt), can look a bit intimidating. It might even give you flashbacks to a high school algebra class you'd rather forget. But instead of seeing it as some dry equation, think of it as the actual blueprint for building wealth.

Every variable in that formula plays a crucial role in your financial story. Let's break this powerful tool down, piece by piece, so you can see exactly how it works.

The Variables of the Compound Interest Formula

To really get a handle on the formula, it helps to think of each component as a lever you can pull to change the outcome. Some levers have a bigger impact than others, but they all work together to determine your final result.

This table breaks down each "character" in the formula: A = P(1 + r/n)^(nt).

| Variable | What It Represents | Example | Impact on Growth |

|---|---|---|---|

| A | The Final Amount | Your future balance | This is your end goal—the total value of your investment after growth. |

| P | The Principal | Your initial $5,000 deposit | A larger starting principal gives you a bigger base to grow from. |

| r | The Annual Interest Rate | 5% return (0.05 in the formula) | A higher rate means your money grows faster each year. |

| n | The Compounding Frequency | 12 (for monthly compounding) | More frequent compounding means you earn interest on your interest sooner. |

| t | The Time in Years | 20 years until retirement | Time is the most powerful multiplier; the longer you invest, the more dramatic the growth. |

Each part of this equation tells a piece of your investment’s story. By understanding them, you're no longer just looking at numbers; you're seeing a clear path to your financial future.

This "snowball" effect is the core concept. Your money earns interest, that interest gets added to the pot, and the new, larger amount starts earning even more interest. It’s a cycle of growth that builds on itself.

As the visual shows, the longer you let that snowball roll, the more powerful the "interest on interest" effect becomes. That's what leads to exponential gains.

Putting the Formula Into Action

Okay, let's move from theory to a real-world example.

Imagine you have $1,000 to invest. You find an account offering a 6% annual interest rate, and the interest is compounded monthly. You plan to leave that money completely untouched for 10 years.

Let's plug our numbers into the formula:

- P (Principal) = $1,000

- r (Annual Interest Rate) = 0.06 (remember to convert the percentage to a decimal)

- n (Compounding Frequency) = 12 (since it's compounded monthly)

- t (Time in Years) = 10

Now, we just pop these values into A = P(1 + r/n)^(nt):

- A = 1000(1 + 0.06/12)^(12*10)

- A = 1000(1 + 0.005)^120

- A = 1000(1.005)^120

- A = 1000(1.819396734)

- A = $1,819.40

After 10 years, your initial $1,000 has grown into $1,819.40. The incredible part? You earned $819.40 in interest without lifting a finger. You just let the formula do its thing.

This hands-on approach shows the formula isn't just abstract math; it's a predictable engine for growth. By learning how to calculate compound interest yourself, you gain a much deeper appreciation for how small, consistent actions can lead to huge financial outcomes down the road. This is the foundational knowledge you need to make smarter decisions, whether you're saving for retirement or planning your next big investment.

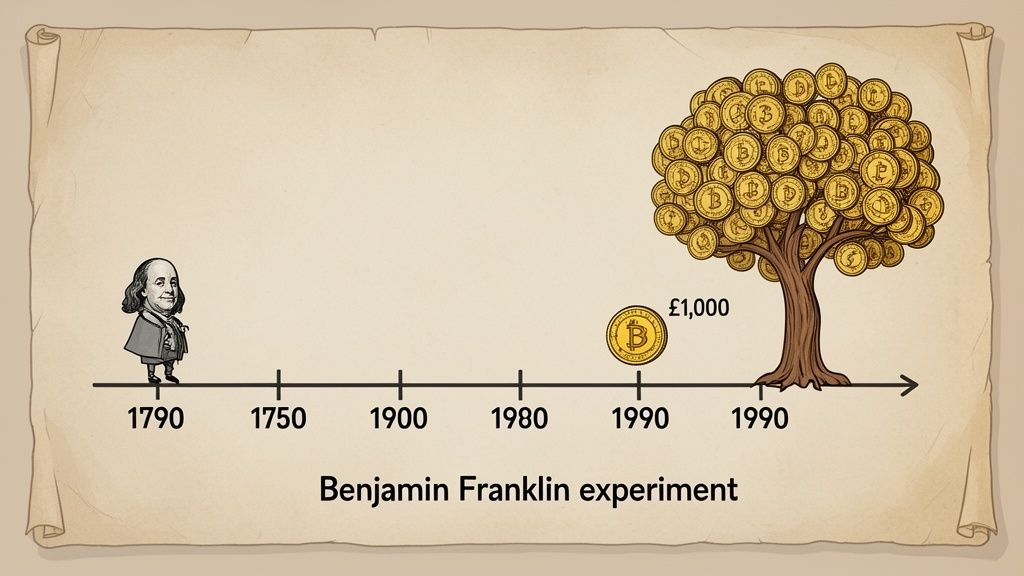

How a Founding Father Proved the Power of Time

The compound interest formula feels like a modern financial concept, but its core principle is ancient. In fact, one of the most compelling demonstrations of its power wasn't a computer model but a real-world, 200-year experiment launched by one of America's own founding fathers.

This isn't just a hypothetical what-if; it's a legendary tale of financial foresight. Picture this: it's 1790, and an 84-year-old Benjamin Franklin decides to put compound interest to the ultimate test. In his will, he left 1,000 pounds sterling to both Boston and Philadelphia, but with a fascinating catch. The money had to be invested and left to grow for 100 years, at which point some could be used for public projects, with the rest left to compound for another century.

The results were staggering. By the time 1990 rolled around, Boston's fund had ballooned to $4.5 million, and Philadelphia's had hit $2.3 million. It's an incredible story you can read more about in this piece on the history of compounding interest.

This story is more than just a historical anecdote; it's a living, breathing example of the formula A = P(1 + r/n)^(nt) playing out on an epic scale. Franklin's initial gift was the principal (P), and the 200 years served as an incredible amount of time (t).

Turning Pennies Into a Public Fortune

Franklin’s grand experiment is the perfect case study for the variables in our formula. Let's look at how his vision maps directly to the concepts we've been discussing.

- Principal (P): The initial £1,000 was a fairly modest seed. It's proof that you don't need a huge starting sum for compounding to work its magic.

- Time (t): At 200 years, this is the most dramatic variable in his entire plan. Franklin knew that time was the ultimate amplifier, capable of turning a small gift into a city-altering fortune.

- Rate (r) and Frequency (n): The money was invested in loans to young tradesmen, and the interest earned was plowed right back into the fund. That cycle of earning and reinvesting is the very engine of compounding.

Franklin essentially created a financial snowball and gave it two centuries to roll downhill. The result was millions of dollars funding everything from trade schools and science museums to scholarships.

Benjamin Franklin's bequest is the ultimate proof that the most powerful ingredient in the compound interest formula isn't the size of your principal or the rate of return—it's the length of time you stay invested.

From Franklin's Vision to Your 401(k)

An 18th-century financial plan might seem worlds away, but the logic behind it is the exact same force that drives your modern retirement goals. The growth engine inside a 401(k), an IRA, or any long-term investment is running on the very same principles Franklin used.

His experiment leaves us with three critical lessons that are just as true today:

- Start as Early as Possible: Time is your single greatest asset. The sooner you start investing, the more doubling cycles your money gets to experience.

- Patience Is Paramount: Franklin’s plan demanded unbelievable patience, locking the money away for generations. For us, that translates to resisting the urge to sell during market downturns and simply letting the process work.

- Consistency Over Lump Sums: While Franklin began with one sum, the principle also champions consistent contributions. Every new deposit into your retirement account is like planting another seed that grows alongside the others.

By looking back at Franklin’s incredible foresight, we can see the compound interest formula not as some dry equation, but as a timeless strategy for building real, lasting wealth. His gift wasn't just money; it was a lesson in financial patience that is still paying dividends today.

Applying the Formula to Your Financial Goals

This is where the magic happens. Knowing the math behind compound interest is one thing, but seeing it actively shape your financial future is another entirely. We're moving from the textbook to your real-life plans.

By plugging in your own numbers, the formula stops being an abstract equation and becomes a practical roadmap for hitting your biggest goals. Whether you're dreaming of retirement in 30 years or saving for a house in five, the engine of compounding works the same way.

Let's walk through a few scenarios to see how this plays out for different timelines and ambitions.

Example 1: Planning for Long-Term Retirement

Retirement can feel like a lifetime away, but that long horizon is exactly what makes compound interest so incredibly powerful. Time is your greatest ally, giving your money decades to multiply on its own.

Imagine a 30-year-old planning to retire at 65.

- Goal: Build a retirement fund over 35 years.

- Strategy: Start with $10,000 and add $500 every month.

- Assumed Rate of Return: A historical market average of 7% per year, compounded annually.

Doing this calculation by hand with monthly additions is tricky, but online calculators make it easy. Anyone with a long-term focus should be exploring strategies to maximize retirement savings—it’s the key to making the most of all that time.

Over 35 years, the $220,000 in total contributions could balloon to over $950,000. Think about that for a second. More than $730,000 of that final sum is pure growth—your money making more money.

Example 2: Saving for a Medium-Term Goal

Not every goal is on the distant horizon. What about something more immediate, like a down payment on a house? The timeline is shorter, but compounding still gives you a serious leg up.

Let's say you want to save $50,000 for a house deposit within 10 years.

- Goal: Reach $50,000 in 10 years.

- Strategy: Begin with $5,000 and invest $300 per month.

- Assumed Rate of Return: A more conservative 5% annual return, compounded monthly.

In this case, your total contributions of $41,000 (the initial $5,000 plus $300 a month for 120 months) would grow to nearly $52,900. The interest earned adds almost $12,000 to your pot, helping you cross the finish line faster and with less money out of your own pocket.

Example 3: Modeling a Modern Investment

The formula isn't just for savings accounts. It's a fundamental tool for understanding the potential of more volatile assets like stocks or even cryptocurrencies. Of course, returns are never guaranteed, but modeling the upside helps you set realistic expectations.

Let's map out a hypothetical investment in a growth stock.

- Principal (P): A $2,500 initial investment.

- Time (t): A 5-year holding period.

- Hypothetical Rate (r): An aggressive 12% average annual return.

- Frequency (n): Compounded annually (1).

Running these numbers through the formula A = P(1 + r/n)^(nt) looks like this:

- A = 2500(1 + 0.12/1)^(1*5)

- A = 2500(1.12)^5

- A = 2500(1.7623)

- A ≈ $4,405.85

Here, an initial $2,500 could potentially become more than $4,400 in just five years. This shows how a higher rate of return can accelerate growth, even over shorter periods. To get a better handle on measuring these types of gains, check out our guide on https://shiftshift.app/blog/how-to-calculate-investment-returns.

Key Takeaway: The compound interest formula isn't just theory—it's a versatile tool for real-world planning. It lets you set tangible goals, see the direct impact of your savings habits, and map out a clear path to get where you want to go.

Estimating Your Investment Growth with the Rule of 72

Let's be honest. The full compound interest formula is a powerhouse, but it's not exactly something you can scribble on a napkin while weighing a financial decision. What if you just need a quick, reliable way to grasp the power of compounding without reaching for a calculator?

This is where the Rule of 72 comes in. It’s a brilliantly simple mental shortcut for estimating how long it’ll take an investment to double at a given annual interest rate.

This isn't just some random number; it's an incredibly useful tool for making financial concepts tangible. Whether you're comparing two different savings accounts or trying to understand the potential of a stock, this rule gives you a fast, surprisingly accurate estimate.

How to Use the Rule of 72

The beauty of the Rule of 72 is its simplicity. To figure out the approximate number of years it takes for your money to double, you just do one quick division:

72 ÷ Annual Interest Rate = Years to Double

That’s all there is to it. No exponents, no complex calculations. Just divide 72 by the interest rate (as a whole number, not a decimal) to get a clear timeline.

This clever shortcut has roots going all the way back to the Italian mathematician Luca Pacioli in his 1494 book Summa de arithmetica. For a deeper dive into its origins, check out the history of this concept on Wikipedia.

Think about what this means in practical terms. If you have a savings account earning a modest 2%, it will take 36 years for your money to double (72 ÷ 2). But if you invest in the stock market and get an 8% average return, that timeline shrinks to just 9 years (72 ÷ 8). At a more aggressive 12% growth rate? A mere 6 years (72 ÷ 12).

Let's look at a few more quick examples:

- Investment with a 6% return: 72 ÷ 6 = 12 years to double.

- Investment with a 9% return: 72 ÷ 9 = 8 years to double.

- Investment with a 4% return: 72 ÷ 4 = 18 years to double.

This simple math instantly shows how profoundly a higher rate of return can accelerate your wealth-building journey.

Comparing the Rule of 72 to the Exact Formula

So, just how accurate is this mental trick? Let's see how the Rule of 72 stacks up against the precise answer from the full compound interest formula. We'll use the example of a $10,000 investment growing to $20,000.

| Annual Interest Rate | Rule of 72 (Years to Double) | Exact Formula (Years to Double) | Difference |

|---|---|---|---|

| 4% | 18.0 years | 17.67 years | 0.33 years |

| 8% | 9.0 years | 9.01 years | 0.01 years |

| 12% | 6.0 years | 6.12 years | 0.12 years |

As you can see, the estimate is incredibly close to the exact mathematical result, especially for interest rates you typically see in personal finance. That tiny difference is a fantastic trade-off for being able to do such a powerful calculation in your head.

The Rule of 72 empowers you to think critically about time and money on the fly. It transforms abstract percentages into a tangible timeline, making you a smarter and more confident financial decision-maker.

Keep in mind, this rule is a fantastic tool for quick estimates on lump-sum investments. If you're making regular contributions, however, a dedicated compound interest calculator will give you a far more complete picture of your financial growth.

Common Questions About Compound Interest

Even after you've seen the formula in action, a few questions always seem to pop up. And that's a good thing. Getting a real feel for the nuances of compound interest is what separates knowing the theory from actually using it to build wealth or manage debt.

Let's clear up some of the most common points of confusion. Think of this as moving from textbook knowledge to practical wisdom, so you can avoid the usual traps and make smarter financial moves.

What Is the Difference Between Compound and Simple Interest?

This is the big one, and the answer is everything. It explains why one method builds fortunes while the other barely keeps up.

Imagine you have $1,000 to invest at a 5% annual rate.

With simple interest, you earn $50 this year, $50 next year, and $50 every year after that. The interest is only calculated on your original $1,000. It's predictable, linear, and frankly, a little boring.

Now, let's look at compound interest. That first year, you earn the same $50. But here's where the magic happens. The second year, you're not earning 5% on $1,000 anymore; you're earning it on $1,050. So you make $52.50. It's a small difference, but it's the start of a snowball rolling downhill.

Simple interest adds to your money. Compound interest multiplies it. It’s the difference between walking up a flight of stairs and hopping on an escalator that’s slowly picking up speed.

That distinction is why compounding is the engine of wealth creation.

How Does Compounding Frequency Affect My Returns?

Frequency is all about how often the bank or brokerage stops to calculate your interest and add it to the pile. The more often they do it, the better for you. Each time your interest is "compounded," the base for the next calculation gets a tiny bit bigger.

Let's take a $10,000 investment earning 6% a year. Look at how the final amount changes based on how often it's compounded over a single year:

- Annually (once a year): $10,600.00

- Quarterly (4 times a year): $10,613.64

- Monthly (12 times a year): $10,616.78

- Daily (365 times a year): $10,618.31

The differences look small at first glance, right? But stretch that out over 20 or 30 years, and that subtle edge from more frequent compounding can mean thousands of extra dollars in your pocket. This is why you'll often see savings accounts advertise daily compounding—it's a real, tangible benefit that makes your money work just a little harder, every single day.

Can the Compound Interest Formula Work Against Me?

Oh, absolutely. The formula is just math; it has no loyalty. It’s a powerful tool that can either build your wealth or dig you into a deep hole, depending on which side of the financial equation you’re on.

As an investor, it's your best friend. As a borrower, it's your worst enemy.

The most brutal example is high-interest debt, like a credit card. That 21% APR isn't just an annual figure; it's often compounded daily. Every single day, a little bit of interest gets tacked onto your balance. The next day, you’re charged interest on that slightly higher balance.

This is how people get trapped. The same snowball effect that creates a fortune in a retirement account can become a devastating avalanche of debt. Understanding this double-edged sword is probably the best motivation you'll ever find to pay down high-interest debt as fast as you possibly can.

What Common Mistakes Should I Avoid?

Compounding is a fairly straightforward concept, but a few classic blunders can seriously sabotage your results. Staying aware of these is half the battle.

Here are the three big ones I see all the time:

- Ignoring the Impact of Inflation: Seeing a 7% return on your investments feels fantastic, but that number doesn't tell the whole story. If inflation is at 3%, your real return—your actual gain in buying power—is only 4%. Always think in terms of real returns to know if you're truly getting ahead.

- Underestimating the Power of Time: This is, without a doubt, the costliest mistake of all. The exponential curve of compounding means the early years do the heaviest lifting. Waiting just five or ten years to start saving can literally cost you hundreds of thousands of dollars down the line. The best time to start was yesterday; the second-best time is right now.

- Forgetting to Adjust Rates for Frequency: This is a classic math error. When you use the formula A = P(1 + r/n)^(nt), you have to divide the annual rate (r) by the number of compounding periods (n). If you're calculating monthly compounding, you can't just plug in the annual rate. You have to use the monthly rate (r/12). It's a small detail that makes a huge difference.

Keep these pitfalls in mind, and you'll be well on your way to making the power of compound interest work for you, not against you.

Ready to stop guessing and actually see what your financial future could look like? The ShiftShift Extensions ecosystem has a powerful Compound Interest Calculator that makes these numbers come alive. You can model your investments, account for regular contributions, and watch your potential growth on interactive charts—all right inside your browser.

Turn financial theory into a real-world plan. Download the extension from ShiftShift's website and see for yourself how quickly your money can start working for you.